An idea borrowed from our forefathers

If you have not recognised yet what buckets are, let me tell you about something that we have often seen in Indian families—especially the older folks. Whenever they got paid—usually at the end of a month—they would seggregate the money in various envelopes (or repurposed pan-masala tin cans as my grandfather did). Each envelope would have a purpose. There was one meant for grocery shopping (just like our Consumables spend-bucket). Whenever it was necessary to buy someting from the vegetable market, the milkman, or the local grocery store, money would be taken out from that particular envelope, and that was irrespective of who made the shopping trip. There were envelopes that fulfilled their purpose once a year—like the one that would be for buying new clothes during the October festival season (Durga Puja / Dussehra). If we had to save 300 rupees for buying new clothes for everyone (300! Look what inflation has done!), we would put 25 rupees every month in that envelope starting from November, until we had 300 rupees in October next year. A well-planned expense—no matter how large—will never create any agony, or worse, a feeling of guilt.

Companies like You Need a Budget have monetised this well. Honestly, you don't need to pay for any subscriptions to do so. Any spreadsheet software (Excel, Numbers, Libre Office, Google Sheet) will do once you have understood the philosophy. They are all tools to solve a purpose—improve your financial situation. The purpose is important; the tool isn't. You can even use pen and paper to do this.

Creating the spreadsheet

The first idea comes from an age old adage—every rupee you earn should have a purpose. You have already done the exercise to identify various buckets. This puts you in a very strong position to determine what are the various purposes of your income.

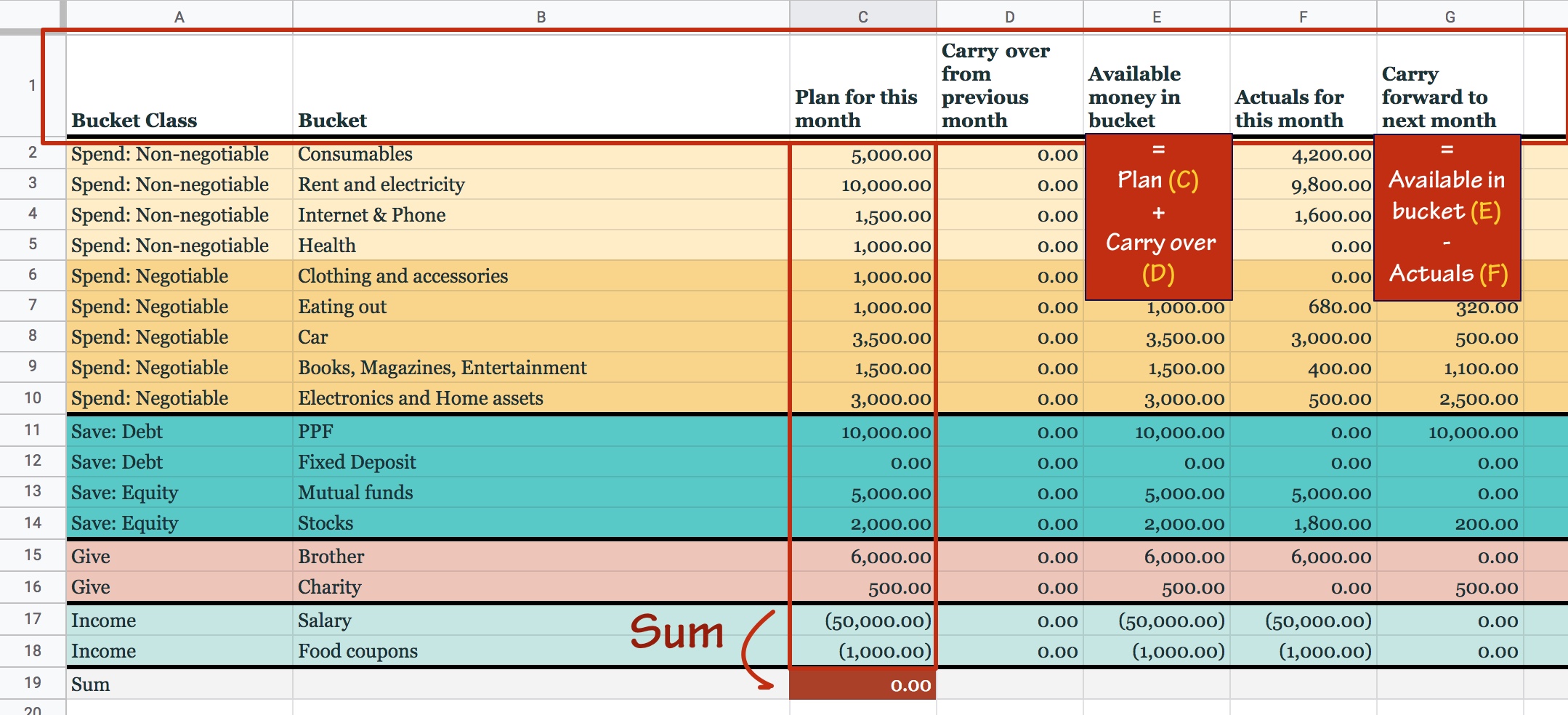

This spreadsheet that you will be making is a mechanism to track your cash flow. Each sheet in the spreadsheet file would track your cash flow for a given month. First, let us study a sample spreadsheet [ link ]. Please feel free to make a copy and play around.

The spreadsheet has some columns whose purpose would have become familiar to you by now, such as the Bucket Class and the various entries in that column, as well as the Bucket column whose entries you would have already identified by now.

We see a bucket class called Income. It is also a negative number. (Finance people use parenthesis instead of a minus sign. That's convention—go figure!) Well, it was bound to be there. After all this is a record of cash flow—there has to be some kind of inflow as well.

Modify the spreadsheet to reflect your buckets and income sources

Once you have clearly defined your buckets, it's time to balance. The sum of the entire Plan for this month column should be equal to (or close to) zero. This means that all your income (denoted by a negative number) has been allocated for some kind of an outcome (denoted by a positive number). This will ensure that every rupee you earn has a purpose, even if the purpose is hedonistic in nature (or altruistic, or ascetic, or basic, or whatever-ic—there are only three things you can do with your money and by now you know that very well). This brings me to your next task.

Balance your income with your plan

At first, you might have some trouble in balancing these numbers. If your income exceeds the aggregate of your other three bucket classes, then congratulations! Maybe you would want to increase a bit more on the give side. Or maybe, you would want to hold on until you are able to compute how much you should save and park the excess money in any of the save-buckets. If your aggregate of the three buckets exceeds your income, it's high time you look at either of the two scenarios—adjust your lifestyle to reduce your spend-buckets, or find another job that pays better. Irrespective of whether you are able to land a higher paying job, adjusting your lifestyle to your means is always a wise thing to do.

If you are setting this up for the first time, chances are that you wouldn't have any money accumulated in any of the buckets. You can set all entries under Carry over from previous month to zero. The Available money in the bucket is a summation of your current plan and the carry over from the previous month. As you fill the Actuals column with the actuals, the money that is left over in the bucket will be carried forward to the next month. And that's exactly what Carry forward to the next month computes.

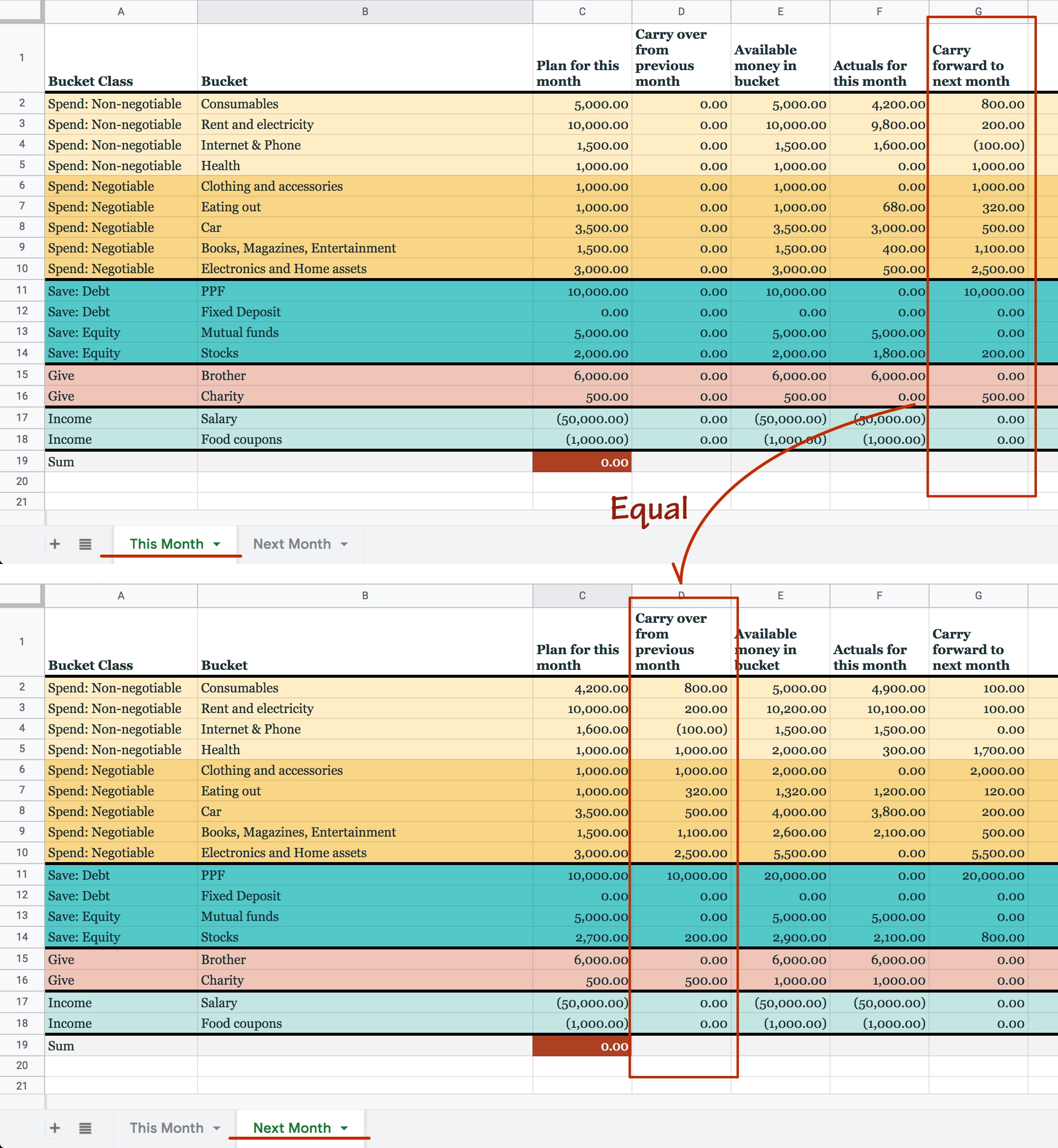

You can use the standard spreadsheet =<Sheet-Name>!<Cell> formula to link them (just like in the sample sheet) or manually copy them prior to next month's planning (like my sister does). Also, don't forget to use meaningful month names like May-2021 or June-2021 instead of This Month and Next Month as in the sample spreadsheet.

Now that you have understood the philosophy, it's time for another exercise.

Record your actuals for an entire month

Don't forget to record your actual income, too. If you are a salaried person, the planned income will be same as actual income. (Chances are that you would be preparing the sheet after recieving the salary anyways!) If you run a small business, your income might not be credited by your customers in one go. If you have multiple sources of income, it is not unlikely that you will be credited in the middle of the month. You can update the income actuals as and when you recieve it. In general, if you do not want to update the actuals daily, it's still alright. Choose a frequency to update this sheet at least once a week. Personally, I update any large sum like house rent, insurance, deposit, etc. the very same day. I record my consumables in a notebook and update the sheet at least once a week. You will have to figure out a way such that the system easy for you to work with.

In the next section we will touch upon some cases that might arise due to carry over.